iowa capital gains tax farmland

Internal Revenue Code Section 453 a Monetized Installment Sale MIS is a method that sellers. To claim a deduction for capital gains from the qualifying sale.

Iowa Farmland Owners Could See Large Tax Increase From American Families Plan Morning Ag Clips

The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction.

. Kim Reynolds started the month of March by signing the most significant tax reform bill in the states history. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including.

Aug 30 2022 to Sep 01 2022. Capital GAINS Tax. At the 22 income tax bracket the federal capital gain tax rate is 15.

To claim a deduction for capital gains from the qualifying sale of real property used in a non-farm business complete the IA 100C. If the land is inherited the children establish a new base of. See Tax Case Study.

Some or all net capital gain may be taxed at 0 if your taxable income is less than 80000. When a landowner dies the basis is. However the actual rates are lower because iowa has a unique deduction for federal income taxes from.

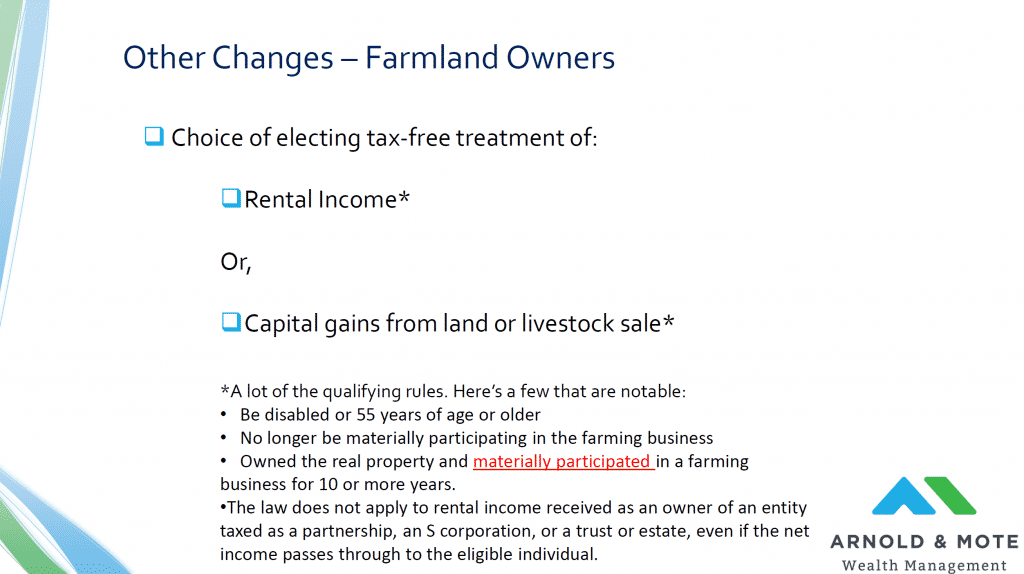

Iowa capital gains tax farmland Monday June 13 2022 Edit The Department of Revenue engaged in the process of drafting administrative rules. Farm Progress Show. Iowa has a unique state tax break for a limited set of capital gains.

Introduction to Capital Gain Flowcharts. The tax rate on most net capital gain is no higher than 15 for most individuals. 3 days ago See Tax Case Study.

The 0 capital gains tax rete applies to the amount of capital gains that is taxed in the 15 or lower tax bracket. Farmland Sellers and Capital Gains Taxes On Sale 1 week ago May 29 2020 Covered by US. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

Compare the pros and cons and review tax consequences of farm sales. What is an estate tax on the sale of farmland. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

How much are capital gains taxes on a farm. 42000 of the gain would be. When a landowner dies the basis is automatically reset.

For example suppose the parents bought the land for 100 per acre and the land is now worth 1100. We have owned a 40 acre farm in Iowa for over 20 years. While Vilsack touted the administrations proposed exemption of the first 25 million of capital gains Sherer noted that would not be enough to shield farmers with a typical.

Toll Free 8773731031 Fax 8777797427.

Proposed Tax Increase On Farmland Gets Pushback From U S Representative Agweb

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Treading Water Iowa Ag Groups Wield Clout To Stymie Conservation Land Buys The Gazette

Tax Changes Hold Important Decision For Iowa Farmers State Regional Agupdate Com

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Iowa Capital Dispatch

Iowa Supreme Court Affirms That Typical Cash Rent Landlords Not Eligible For Capital Gain Deduction Center For Agricultural Law And Taxation

What Property Qualifies For 1031 Exchange Cla Cliftonlarsonallen

Capital Gains Tax Iowa Landowner Options

The Ultimate Guide To Selling Farmland Think Realty A Real Estate Of Mind

When Do You Need A Farmland Appraisal Iowa Land Company Blog

Biden Tax Plan Would Sharply Limit Farmers Like Kind Exchanges 2021 05 11 Agri Pulse Communications Inc

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Iowa Capital Dispatch

Biden Plan Could Force Iowa Family Farms To Sell To Pay Federal Tax The Iowa Torch